Anthropic is Killing Bitcoin

The AI-native currency already exists - hiding in plain sight, outperforming crypto by six orders of magnitude.

The Dawn of the Total Machine Economy

We are at the beginning of the total-machine economy — and you’re holding the wrong money.

You’re about to see a shift most people in crypto and AI are still missing.

While you’ve been watching Bitcoin prices and AI hype cycles, one company has been assembling financial infrastructure that operates beyond the architectural limits of Bitcoin, Ethereum, and everything else in the current crypto stack.

And yet most people around us don’t notice what’s happening. This revolution isn’t as loud as the ones before: it’s unfolding more quietly than that. Racks of machines coming online, one data center at a time. We’re still in the early stage but the growth is exponential — which is exactly why it’s so easy to miss.

What that looks like in practice takes about three seconds to understand. Just watch the animation below:

But this animation shows only the surface. Here’s the part that should worry every Bitcoin holder:

You’ve already been using this currency without realizing it.

This isn’t a currency that’s coming. It’s already running: processing billions in value daily, secured by physical infrastructure, priced and settled in real time.

At some point, someone will formalize it into an explicit AI coin — but by then, the early-adopter window will already be closed.

Let me show you how it reframes everything.

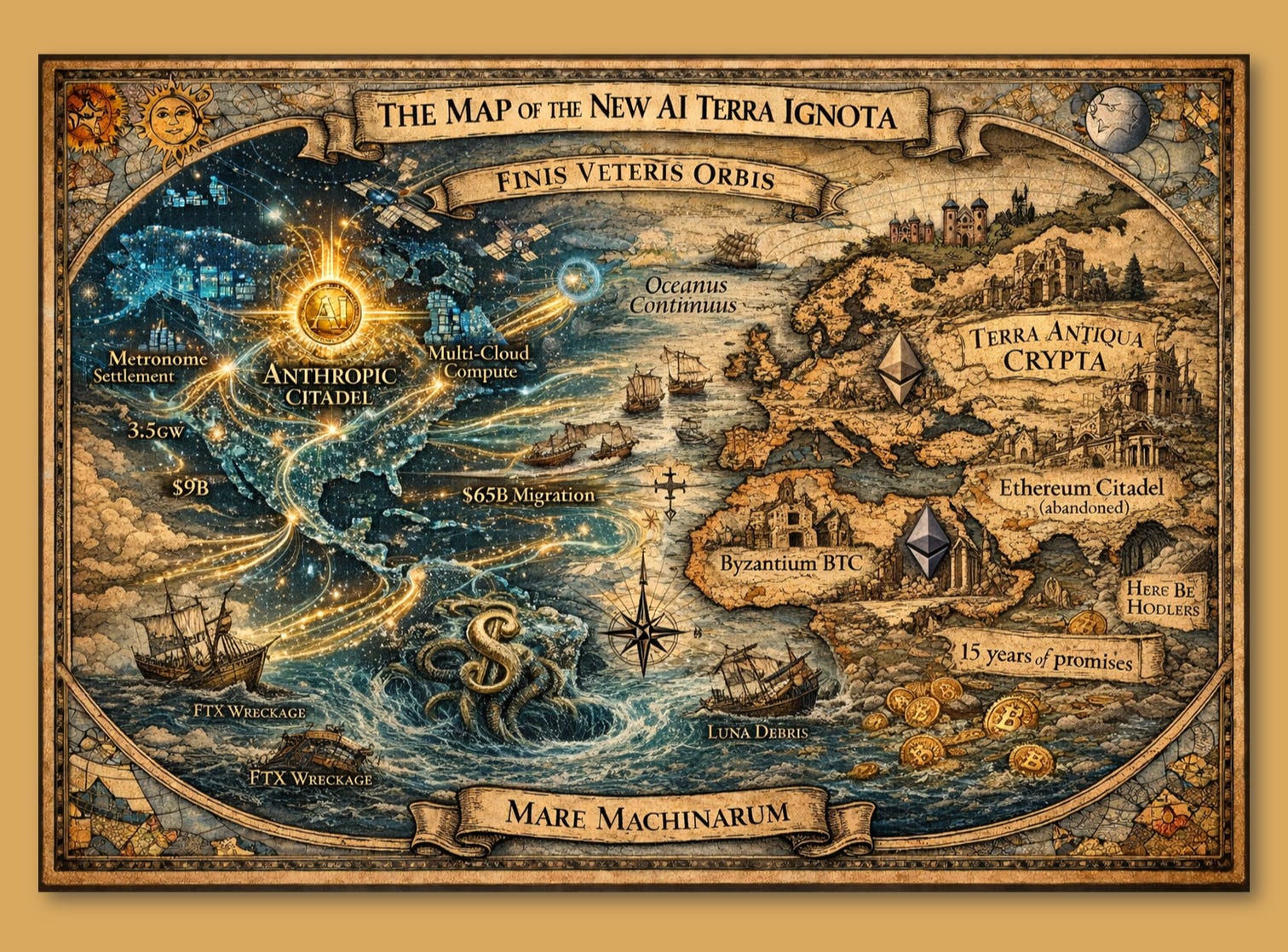

THE EXODUS

Let’s start by following the money as GPS to show us where the future will be: between cryptocurrency country roads and the new AI multi-infrastructure heavy highways.

TL;DR: Money is escaping the cryptocoin hype faster than it entered years ago. The promises of an economy built on cryptocoins never materialize; and in the meantime, new tech has already begun turning the entire crypto landscape into tech archaeology.

Don’t believe me? Then let me show you two charts that tell the whole story.

The Crossover

Look at these two charts below together. They’re telling the same story from opposite ends.

At the bottom: AI is swallowing everything else. In just two years, it moved from a quarter to half of all global venture funding. Half of every investment dollar on earth now flows into AI, while fintech, crypto, biotech, and SaaS fight over the scraps. And the trajectory shows no sign of slowing down.

At the top: the physical evacuation. Bitcoin miners are watching their revenue share collapse in real time. That crossover point on the chart isn’t decorative — it marks the exact moment when AI compute contracts became more valuable than Bitcoin mining on the very same hardware. Same racks. Same cooling systems. Same electricity bills… but taken over by AI guys paying more.

One chart shows where the capital is going. The other shows where it’s coming from. These aren’t two trends: it’s one migration, captured from both ends.

The capital didn’t disappear. It changed industries.

The Contracts and The Hedge

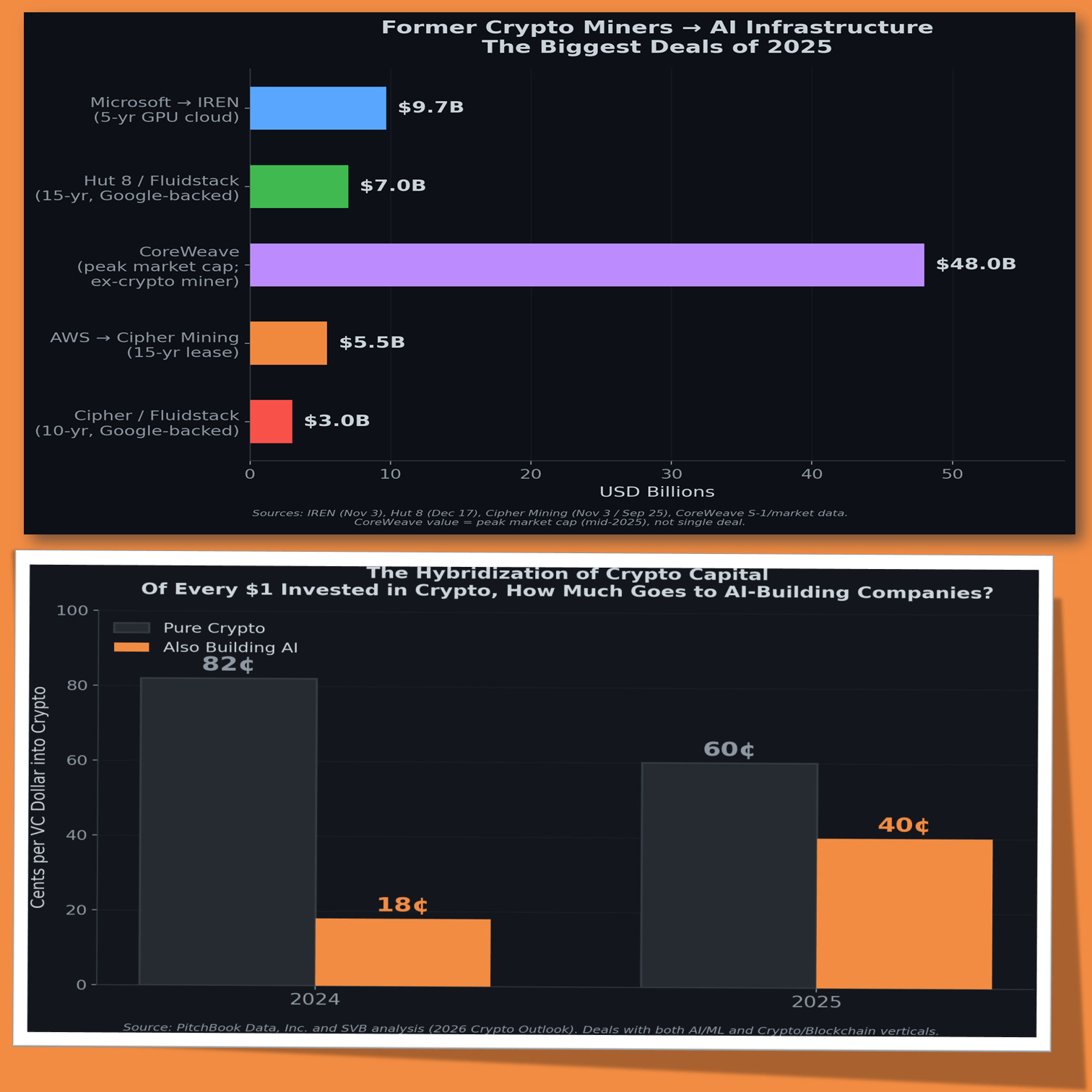

The first two charts showed you the flow. Now let me show you the receipts.

These aren’t projections. These are signed contracts — the names and amounts are in the chart below. What should stop you cold is who signed them: companies that used to mine Bitcoin, now locking themselves into AI infrastructure deals that stretch a decade or more.

These aren’t hedges. This is the exodus — the moment the people who built crypto started buying their tickets out of it.

And the bottom Figure 3 reveals something the contracts alone can’t tell you: where this is heading. The funding ratio between AI and crypto isn’t just wide — it’s widening. Every quarter, the gap grows. Project that curve forward two years and crypto venture funding doesn’t shrink gradually. It becomes an investment anecdote.

Now the betrayal is becoming explicit. Pantera Capital — the first US institutional fund built exclusively on blockchain: is pouring hundreds of millions into AI. Bloomberg reported that crypto VC funds are actively shifting away from tokens.

The people who built their careers on crypto are quietly moving their chips to the other table. When insiders build lifeboats with their own money, that’s not a cycle, it’s the end of the explosive cryptocoin Cambrian era.

Bye bye BTC

Still not convinced? Fair enough. Now let me show you why the money is leaving.

Imagine you own a data center. You’ve been renting it to Bitcoin miners for years. Then some AI investor guy walks in and offers you a decade-long lease at margins that make your crypto tenants look like they’ve been paying in loose change. A hyperscaler’s signature on a contract that prints money for fifteen years.

Which tenant do you keep?

That’s not a thought experiment. That’s what’s happening right now across every major mining operation on earth. And here’s what nobody’s talking about: they’ll still mint a new kind of coin — an AI-native one — pretty soon, while profiting from the infrastructure that makes all of AI run.

How? That’s what comes next.